Keeping People Housed

Keeping People Housed offers an interest-free loan to families and individuals on the Sunshine Coast who meet the eligibility requirements during a temporary and unexpected financial crisis.

Keeping People Housed is a loan program to help members of the community with unexpected and temporary crises for rental arrears or essential utilities and re-payment is made monthly through your bank account.

The loans, $1,300 maximum for a single person and $1,800 for families can be used for:

- rental arrears/pastdue

- utility arrears/past due

- security deposits

A pre-assessment is required to determine eligibility to proceed with an application package.

Eligibility

- 19 years of age

- resident of the Sunshine Coast

- less than two months of rental and/or essential utility arrears

- have a current bank account & consent to direct debit

- have a regular source of verifiable income

- financial crisis is temporary and unexpected

- are unable to access any other forms of financial assistance

- have one piece of government ID with photo

- explain how the loan will stabilize housing situation

- don't have any outstanding loans with the Keep People Housed program

- are not in the process of bankruptcy

- able to provide proof of income, proof of tenancy and three months of up-to-date bank records

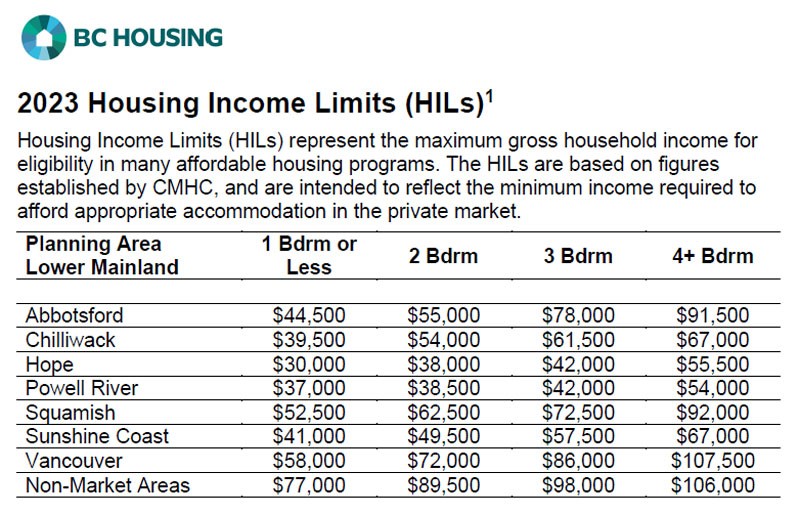

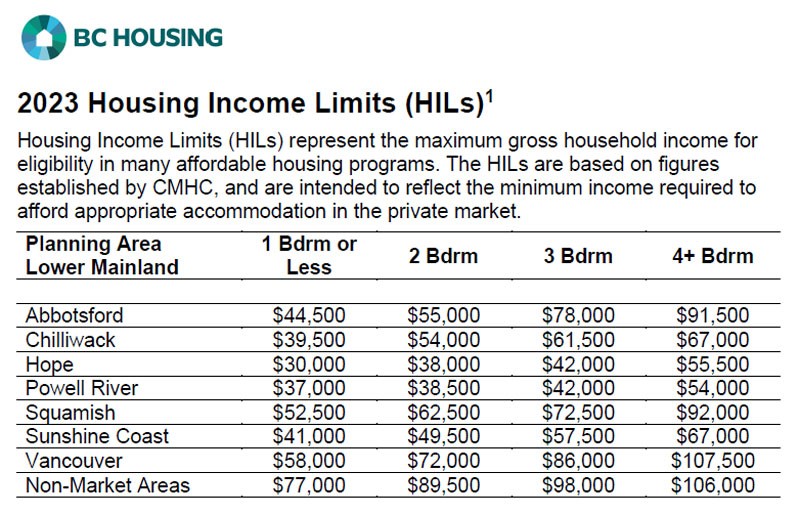

- have income less than low-income cut-off

BC Rent Bank has created an online pre-assessment form for Keeping People Housed. You can click here to access the pre-assessment form.

To apply for the loan, documentation required includes proof of income, proof of I.D., proof of residency and a bank account. Please see complete eligibility and necessary document information below.

The program is made possible in part from Sunshine Coast Credit Union, the Co-Operators, BC Rent Bank and Sunshine Coast Community Services.

Program Details

- 19 years of age

- resident of the Sunshine Coast

- less than two months of rental and/or essential utility arrears

- have a current bank account & consent to direct debit

- have a regular source of verifiable income

- financial crisis is temporary and unexpected

- are unable to access any other forms of financial assistance

- have one piece of government ID with photo

- explain how the loan will stabilize housing situation

- don't have any outstanding loans with the Keep People Housed program

- are not in the process of bankruptcy

- able to provide proof of income, proof of tenancy and three months of up-to-date bank records

- have income less than low-income cut-off

Applicants should expect to answer questions about their finanical, housing and income situations.

Bring your:

- most recent pay stubs (preferably four but a minimum of two) or letter from employers

- child tax benefit document or statement

- old age security or pension statements

- documentation regarding child support payments

- documents regarding Working Family Supplement Expenses

- bank statements for the last three months

- copies of bills (Hydro, Fortis)

- Canadian issued photo identification card (license, passport)

- eviction notice (if applicable)

- voided check or automatic withdrawal slip

- proof of residency:

- lease/tenancy agreement

- rent receipts (minimum of two from the last six months)

- rental payment ledger (provided by landlord)

- rental agreement

What Can the Loans Be Used For?

- rental arrears/past due rent

- utility arrears

- security/damage deposits

What if someone lives in subsidized housing?

If someone live in BC Housing, Keeping People Housed is not able to make them a loan for rental arrears. We can contact their landlord to setup a payment plan. If you live in other subsidized housing, we may be able to make a loan; however, the first step is always to attempt a payment plan with the landlord.

Is there a maximum amount someone can request?

Yes. The maximum a single person may request is $1,300. The maximum a family may request is $1,800.

How are the funds provided?

If someone is approved for a loan, the funds are provided in cheque form to the creditor (landlord, BC Hydro, Fortis, etc).

How long does the process take?

We try to respond as soon as possible and have the process completed applications within 10 business days.

What can someone expect from the interview?

The interview is an essential step in the loan application process. Be prepared to provide banking information and answer questions about past, current and future spending, budgeting, income streams and debt. The goal of the interview is to determine if you meet the eligibility criteria and can provide the relevant requirements. We welcome friends, family and support persons at the interview.

How does someone pay back the loan?

- The maximum repayment term is two years

- This is an interest free loan

- Loan repayment amounts:

- A loan of $800 will require a monthly payment of approximately $33.30/month*

- A loan of $1300 will require a monthly repayment of approximately $54/month*

- A loan of $1800 will require a monthly repayment of approximately $75/month*

- Monthly payments are automatically withdrawn from your bank account

Financial Literacy Resources

Check out these financial resources available to you:

- Credit Counseling Society - The Credit Counselling Society

- Family Services of Greater Vancouver - C-19 Money Navigator

- Prosper Canada - Financial Literacy Toolkits

- Financial Consumer Agency of Canada (FCAC) Online financial literacy modules

- SCCSS Client Navigator

Information Sessions

For agencies or service providers seeking more information, please contact Steve to schedule an information session.

Steve Oka

604-885-5881

5561 Wharf Ave., Sechelt

navigator@sccss.ca

Give Today

Give Today  Get Involved

Get Involved  Stay Connected

Stay Connected